Activities

aventron is a holding company for water-, wind- and solar-power plants. The company acquires ready-to-build or existing power plants and operates them. Typical take-over objects are renewable enery power stations producing between 200 kW and 50 MW in Switzerland, France, Italy, Germany, Spain and Norway. aventron is structured along corresponding country holdings, which own the respective project companies. The company supervises the construction and operation of the installations, organises, if required, the financing, makes operational improvements and is responsible for the financial control and reporting of the group.

History

aventron was founded in November 2005 by Elektra Birseck Münchenstein (EBM) as Kleinkraftwerk Birseck (KKB). With Energie Wasser Bern (ewb) and Stadtwerk Winterthur (SWW), two more Swiss energy supply companies participate in KKB in 2010 and 2013.

The two Birskraftwerke Laufen and Dornachbrugg formed the basis of the company. In 2010, KKB entered the French market with the purchase of seven small hydropower plants. Following a capital increase, the company went public in the same year; aventron is listed on the Bern Stock Exchange BX Swiss (BX). With further acquisitions in the areas of photovoltaics and hydropower in France, the growth strategy was successfully continued in 2011 and 2012. At that time, KKB was already an independent Swiss green power producer operating solar, wind and hydropower plants in two European countries.

In the 2013 financial year, this was followed by a further investment in hydropower in France and the construction of large-scale photovoltaic plants in Switzerland. The construction of a wind power plant in the north-western French department of Loire-Atlantique also marked the company's entry into wind energy.

The 2014 business year was characterised by expansion and diversification. KKB founded three more national companies in Italy, Germany and Norway and acquired additional power plants.

At the end of 2015, KKB managed a portfolio of small power plants in the areas of hydro, wind and solar energy in now five countries. Their total installed capacity was 160 MW (pro rata).

With its 10th anniversary in December 2015, the company introduced the new name aventron.

In August 2016, aventron successfully carried out the largest capital increase in its history to date, for CHF 131.9 million, while preserving subscription rights for existing shareholders. More than 14.6 million new registered shares (par value CHF 1) with an issue value of CHF 9.00 were issued. Of these, 6.4 million shares were paid up in cash and 8.2 million shares were paid up through contributions in kind from wind and solar power plants. After the capital increase, aventron's share capital amounted to CHF 34.1 million. At the same time, the market entry in Spain was realised with the contributions in kind.

aventron continued its acquisition activities steadily in 2017 and 2018. In particular, the hydropower in Norway and solar power in Italy segments grew strongly during this period. In August 2018, aventron completed a capital increase of CHF 94.3 million. 35.4 million was contributed in cash and 58.9 million as contributions in kind of wind and solar assets.

The 2020 and 2022 capital increases provided aventron with over CHF 100 million in new liquid assets, which enabled further expansion. In December 2021, aventron's portfolio reached 680 MW.

Ownership

aventron AG is 62.2 percent owned by aventron Holding AG. Other shareholders holding more than 5 percent of aventron shares are UBS Clean Energy Infrastructure Fund II with 6.7 percent, Reichmuth Infrastruktur Schweiz with 5.5 percent and Credit Mutuel Equity (CIC Capital Switzerland) with 5.8 percent.

The shares of aventron AG can be traded on the OTC-X of BEKB and have a free float of 4.8 percent (shareholders with an interest of less than 3 percent).

There are 54,204,526 registered shares.

Structure

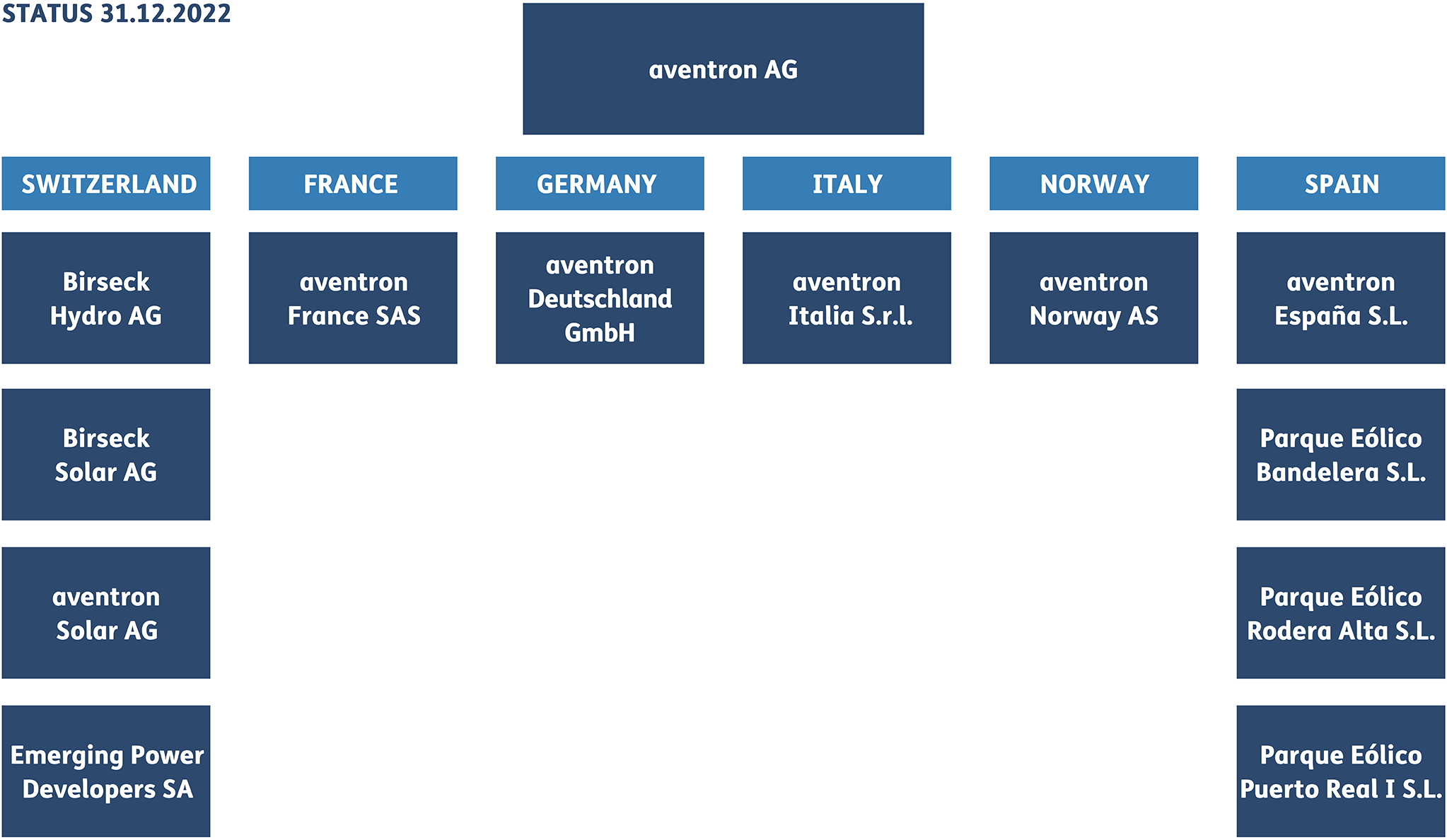

aventron AG is a non-listed public limited company. Information on the ownership structure is available in the «Shareholders» section.

aventron AG organises its holdings by country and, where applicable, by technology. The company acts as the Swiss holding company of the whole. The main country subsidiaries are as follows.

Sustainability

The Eco Fund of Birseck Hydro AG

For more than 20 years, 0.7 centimes per kilowatt hour of electricity sold from naturemade-star certified hydropower have flowed into Birseck Hydro's eco fund.

By enhancing habitats for flora and fauna and for us humans, this money goes back into nature and generates added value. Almost 1 million Swiss francs have already been invested in roughly 30 projects for ecological improvement measures in the Birs catchment area.

The steering committee with representatives from the canton of Baselland, ProNatura and aventron AG manages the eco-fund and is responsible for the fund money. Submitted projects are examined by the committee for eligibility for support and the decision is made unanimously.

Applications for funding

Are you planning an ecological upgrade? We would be happy to review your project and provide financial support if it is suitable. The application form and further information can be found here.

Applications are considered by the steering committee once a year, usually in autumn. Please send your application documents by e-mail to the following address: info@aventron.com

Projects - Investments in native nature

Fish ladders accessible to beavers, revitalised river banks or networked habitats for midwife toads - Birseck Hydro AG's eco-fund has supported more than 20 projects with financial resources to date.

In the middle of the Laufen settlement area and in the nearby catchment area of the "Wasserfall" hydroelectric power plant, an approximately 300-metre-long, near-natural watercourse was created. By damming the Ziegelschürbächli, ecological added value was created.

The existing pond, which was created many years ago by nature conservationists, was in a very silted condition. Through targeted improvement measures, the condition of the pond could be greatly improved and the associated ecological added value restored.

In Reinach, a diverse habitat has been created on and in the water and a place for nature observation and recreation. A ridge-like pond has been created in the centre of the area, with three finger-shaped shallow water zones with different water depths in the direction of the Birs and three offset nature conservation ponds in the direction of the H18.

On the western edge of the Kammermatten/Toggessenmatten nature reserve, a diverse habitat for amphibian, reptile and bird species has been realised through various ponds. At the same time, it is an attractive place for local recreation and nature observation.

With the construction of the ponds at four different locations, the still relatively strong population of the Midwife Toad (Alytes Obstetricans, also known as the "Glöggli Frog") in Blauen can be further connected, stabilised and strengthened.

Before the renaturation, the section from Rütihardbrücke to St. Jakob was canalised. The relatively monotonous banks were protected throughout by logs. The revitalisation of the Birs in this area created another recreational area. In addition, the passability for beavers was increased and better connectivity to the already revitalised sections of the Birs was achieved.

By creating two permanent ponds (one already existed and had to be renovated), the insect density in the orchard and thus also the food supply for amphibians and reptiles could be noticeably increased. The total water surface of 160m2 is an excellent hunting ground for various bat species.

The certified quality label «naturemade»

naturemade is the Swiss quality label for energy from 100 percent renewable sources. This quality label is supported by, among others, the WWF, Pro Natura and the consumer forum and is awarded by the Association for Environmentally Friendly Energy.

Our values:

trust, responsibility, passion, pragmatism

Board of Directors

Dominik Baier, born in 1971, Swiss, has been Chairman of the Board of Directors since the 2024 AGM. Prior to this, he was a member of the Board of Directors or Secretary to the Board of Directors since aventron was founded in 2005. He has over 25 years of experience in the energy sector and in management functions. He is currently General Counsel and Corporate Secretary of Primeo Energie and Deputy CEO. He is a lawyer, holds a CAS in finance and accounting and represents Primeo Energie on various boards of directors of affiliated companies and other strategic bodies.

Tobias Haefeli, born in 1980, Swiss, has been Vice Chairman of the Board of Directors of aventron AG since 2024. He is Head of Corporate Finance, Investment and Risk Management at Energie Wasser Bern (ewb) and is Deputy CFO. Prior to this, he worked in financial consulting for several years. He studied business administration at the University of Bern (M Sc BA), Zurich and the University of Rochester (NY, USA) and is a certified member of the Board of Directors. In addition to his mandate at aventron AG, Tobias Haefeli holds various other directorships in the energy sector and is a member of the Investment Committee of the City of Bern Pension Fund.

Beat Huber, born in 1973, Swiss, has been a member of the Board of Directors at aventron since the 2016 Annual General Meeting. At Swiss Life, he is responsible for Swiss business in the field of equity infrastructure, and is also a founder and partner of the consultancy firm, EVU Partners. In addition to his directorship at aventron, Beat Huber also holds various directorships at Swiss electricity production and supply companies. Prior to this, he worked in line management roles within the energy sector for several years, including five years as CFO of Industrielle Werke Basel. He studied economics at the University of Basel.

Michael Stalder, born in 1977, Swiss, has been a member of the Board of Directors at aventron since the 2017 Annual General Meeting and is also a member of the Audit Committee. He is the Deputy Director of the public utility company, Stadtwerk Winterthur, where he is responsible for corporate development. Prior to this, he held a business development position with Axpo Holding AG. As a long-term employee of the Swiss Federal Finance Administration, he also has a great deal of experience in the fields of administration and politics. He studied economics at the University of Basel, and holds advanced post-graduate certificates (CAS) in Public Affairs Management and as a Certified Strategic Professional.

Thomas Bitzi, born in 1975, 1975, Swiss and British, has been a member of the Board of Directors of aventron AG since the 2021 AGM. He has over 20 years of experience in corporate finance and has been a Senior Investment Director at Crédit Mutuel Equity in Zurich since 2017. There he is responsible for direct investments in Swiss SMEs. He holds two other directorships at companies in the industrial and construction-related sectors. Before joining Crédit Mutuel Equity, he worked for 15 years in various functions at Crédit Suisse in Zurich and London (mid-market M&A, investment banking, credit analysis, private equity/venture capital). He graduated from the University of St. Gallen with a degree in business administration (lic. oec. HSG, specialising in finance, accounting and controlling) and holds the title of Chartered Financial Analyst (CFA).

Nicolas Wyss, born in 1978, Swiss, has been a member of the Board of Directors of aventron AG since the 2019 Annual General Meeting. He has over 15 years of experience in the field of corporate finance with an industry focus on energy. Nicolas Wyss is the Head of Infrastructure Investment Management at Reichmuth & Co Investment Management AG (RIMAG) and is on the Executive Board for several infrastructure funds managed by RIMAG. In addition to his directorship at aventron, Nicolas Wyss also holds various other directorships at energy production and waste disposal companies. Before Nicolas Wyss joined RIMAG in 2014, he worked as a Corporate Finance Consultant at PwC for almost six years and as a Sell-Side Analyst at Kepler Equities (now Kepler Cheuvreux) for three years. He studied economics and business administration at the University of Bern and is a CFA charterholder.

Dominik Zimmermann, born in 1978, Swiss, has been a member of the Board of Directors of aventron since the 2024 AGM. He has worked for Primeo Energie since 2014 and has been its CFO and a member of the Executive Board since 1 January 2024. He was previously responsible for reporting, controlling and treasury. Before joining Primeo Energie, Dominik Zimmermann held various positions in corporate development and finance at Alpiq. He studied economics at the University of Basel.

Executive Board

Eric Wagner, born in 1966, French, CEO since October 1, 2022, previously CIO. Eric Wagner started his career as an engineer at EDF and GDF (now ENGIE) in France and Germany in 1990. To gain experience in other business areas, he then worked as a project manager for a consultancy firm in Paris. He returned to the energy sector in 2006 to assist with EBM’s development in France. There, he was responsible for developing the electricity supply partnership between EBM and Direct Energie, including the management of EBM’s network activities in Alsace. In 2010, Eric laid the first foundations outside of Switzerland for what would later become aventron, and developed a portfolio of wind, solar and hydropower plants in France. In 2014, Eric Wagner was appointed COO of aventron. Eric holds a degree from the School of Physics from Grenoble Institute of Technology.

Bernhard Furrer, born in 1971, Swiss, CFO, in office since 2016. After completing his degree in economics (lic. rer. pol.) at the University of Basel, Bernhard Furrer worked as an analyst in asset allocation and bonds research at Bank Sarasin from 1997 to 2000. He worked at F. Hoffmann-La Roche from 2001, first as a controller and later as Head of Group Treasury Middle and Back Office. In late 2006, he moved to EBM as Group Treasurer (until September 2013). From 2010, he simultaneously held the position of Managing Director at EBM Greenpower AG, which successfully expanded the EBM portfolio in the New Renewables sector to 160 MW. Bernhard Furrer is also a certified accounting and controlling expert, and a graduate of AZEK/CEFA.

Marc Jermann, born in 1976, Swiss, COO. After studying mechanical engineering at the University of Applied Sciences Northwestern Switzerland (FHNW), he started his career as a design engineer at Voith Hydro in Germany, a renowned and globally active supplier of hydropower plants. During his time at Voith Hydro, he held various technical, leadership and management positions. In 2019, he returned to Switzerland and started at aventron as an asset manager. Until his nomination as COO of aventron in September 2023, Marc Jermann was CEO of the subsidiary aventron Norway AS, responsible for the operation of hydro and wind power plants in Norway. He was able to specifically expand his wealth of experience in the field of renewable energies through the management of the wind portfolio in Germany and the operation and expansion of the hydropower portfolio in Switzerland.

Dr. Christian Buser, born in 1976, Swiss, CDO. After graduating with a degree in geography in 2002, Christian Buser began working as a project engineer in an environmental consultancy firm. At the same time, he wrote his dissertation at the ETH Zurich. In 2006, he joined Aare-Tessin Ltd. for Electricity (now Alpiq Ltd.) as an assistant to a member of the Executive Board. In 2011, he took over responsibility for all Alpiq's renewable energy activities (project planning/licensing, construction and operation) in Switzerland and France. In 2014, he moved to AF-Consult Switzerland AG as Head of the Renewable Energies and Environment business division, where he worked on power plant construction projects worldwide. From mid-2017, he was responsible for sales and key account management for thermal and renewable energies as well as environmental services. In 2018, he headed the "Asset Development Power Generation" business unit at ewz. From 2019 to 2023, Christian Buser worked at AFRY Schweiz AG, where he was most recently responsible for all activities of AFRY Schweiz AG in these two fields of activity as Head of Environment and Sustainability. He was actively involved in various energy and infrastructure projects in Switzerland and abroad.